Starlink’s new $40 Residential 100 Mbps tier is the company’s most aggressive attempt yet to position satellite broadband as a mainstream alternative for U.S. households. The move resets expectations in a market long dominated by fibre and cable incumbents.

While the new price point does not match fibre on raw performance, it creates a strategic opening in regions where terrestrial deployment is slow, expensive, or grid‑locked by local monopolies.

This article reviews pricing, availability, capacity trends, and competitive implications to understand where Starlink fits and where it doesn’t within the broader broadband market.

Pricing & Speed Landscape

Starlink’s New Structure

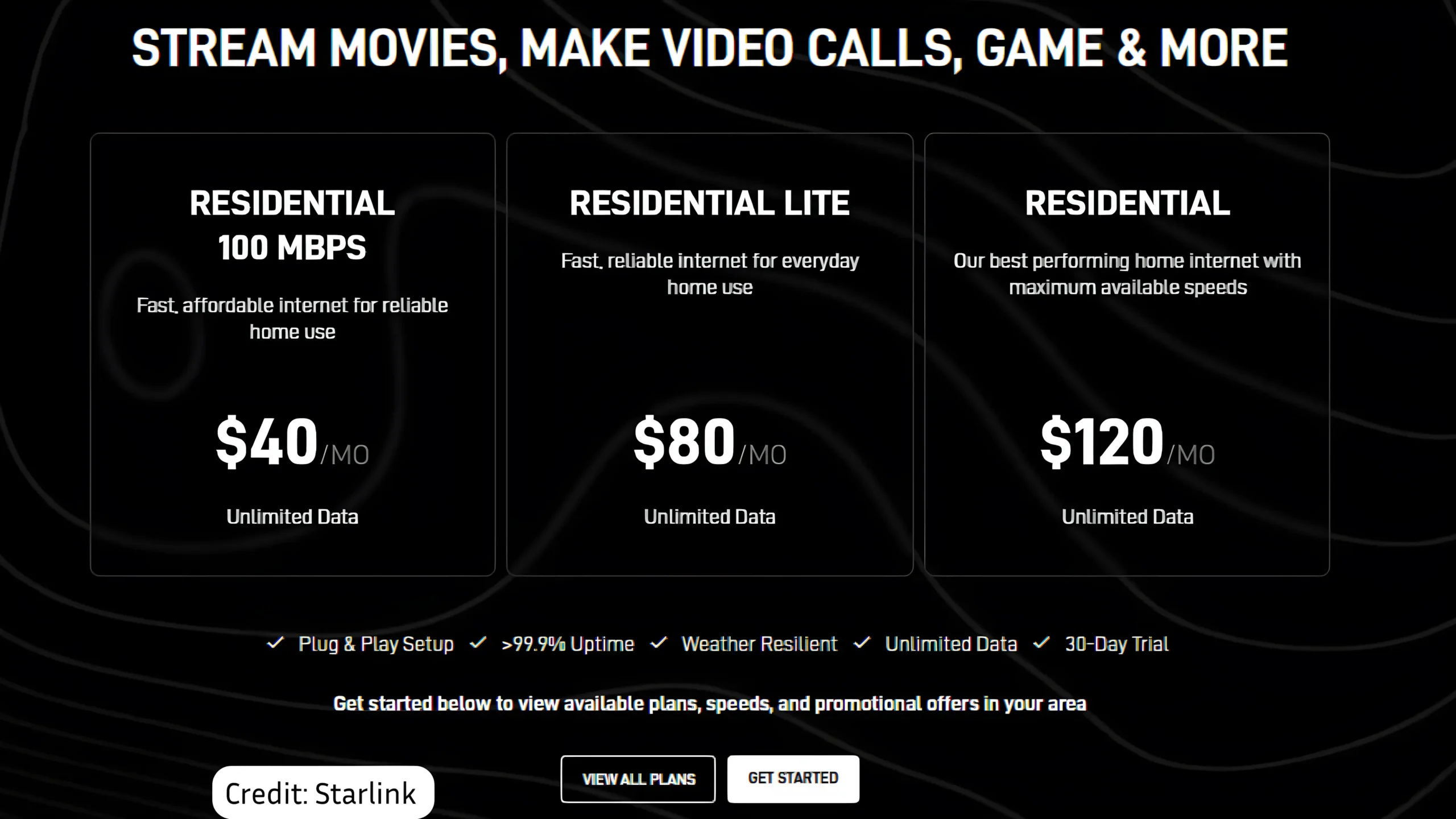

Starlink now has three core residential tiers:

- $40/mo — Residential 100 Mbps (capped at 100 Mbps, unlimited data, $0 kit in select regions)

- $80/mo — Residential Lite (80–200 Mbps typical, deprioritized during peak hours)

- $120/mo — Standard Residential (135–305+ Mbps typical)

The $40 tier eliminates Starlink’s historical equipment cost, previously a ~$349+ barrier, making the total cost of ownership competitive with entry-level cable plans.

Terrestrial Comparison

Fibre and cable still deliver far more throughput per dollar:

- AT&T Fiber 1 Gbps: ~$55–$80/mo, symmetrical speeds

- Xfinity Cable 300 Mbps: ~$40–$55/mo

- Spectrum Internet: ~$30 promo / ~$60 standard for 100 Mbps

High-Level Comparison Table

| Provider | Price | Download | Upload | Data Cap |

|---|---|---|---|---|

| Starlink 100 Mbps | $40 | 100 Mbps | 15–35 Mbps | Unlimited |

| Xfinity 300 Mbps | $40–$55 | 300 Mbps | 10–20 Mbps | None |

| AT&T Fiber 300 | $42 | 300 Mbps | 300 Mbps | None |

| AT&T Fiber 1 Gbps | $55–$80 | 940+ Mbps | 940+ Mbps | None |

Key Insight: Price parity exists only at the 100 Mbps level. Fibre remains unmatched in performance, especially on uploads.

Strategic Context

The $40 tier is not designed to undercut fibre head‑on. It serves three functions:

- Monetizes unused satellite capacity in low‑demand regions.

- Meets the 100/20 Mbps eligibility benchmark for federal BEAD broadband subsidies, which define 100/20 Mbps and sub-100 ms latency as the minimum performance floor for funded projects.

- Expands Starlink’s marketing anchor (“plans start at $40”) while offering higher tiers in congested areas.

This positions Starlink as a value‑driven option where fibre is either unavailable or prohibitively expensive to deploy.

Satellite Constellation Growth

Deployment Scale

Starlink has approximately 7,800 operational satellites, up from the number the company reported in its 2024 network update.

Capacity Evolution

Generational upgrades show major efficiency gains, based on the capacity figures Starlink published in its 2024 network progress report:

- V1.5: ~24 Gbps

- V2 Mini: ~96 Gbps

- V3 (planned 2026+): ~1 Tbps target

Competitive Positioning: Amazon Kuiper

Kuiper is beginning deployment but remains far behind. Amazon has authorization to deploy a 3,236-satellite Kuiper constellation and is still in the early launch phase, so the network is unlikely to challenge Starlink’s scale until the late decade.

Starlink maintains a significant first‑mover advantage, especially in rural and mobile markets.

Mapping Residential Lite Across Countries

United States: Wide ‘white coverage’ areas (zones where Residential + Lite/100 Mbps are both available).

- Most of the U.S. map is now marked white on Starlink’s availability charts. White coverage represents areas where both the $120 Residential and the cheaper Residential Lite / 100 Mbps plans are offered.

- The U.S. is Starlink’s most advanced and highest-density market.

- Starlink has spent the last 2–3 years adding enough satellites to reduce congestion across rural and suburban zones.

- Most of the Midwest, South, and Mountain West support both Residential and Residential Lite. Some dense coastal corridors remain limited to higher‑priced tiers.

Canada: Broad white coverage, with grey zones in dense metro areas

- Canada’s map shows widespread white regions, indicating that the most populated provinces support both Residential and Residential Lite.

- Grey clusters appear mainly around major metropolitan zones like Toronto, Vancouver, Ottawa, and Calgary.

- Canada’s geography makes fibre deployment very expensive, especially outside major cities.

- Satellite adoption accelerated after several provincial programs subsidized Starlink for remote households.

Indonesia: Strong coverage in population centers, limited access in remote provinces

- Indonesia’s map shows broad availability in major islands, Java, Sumatra, and Sulawesi, but restricted zones in less-developed eastern provinces, including Papua and surrounding archipelagos.

- Indonesia is one of the world’s most challenging broadband markets 17,000+ islands, Mountainous terrain, and Limited terrestrial infrastructure.

- Starlink’s rollout here is heavily shaped by regulatory partnerships and government programs targeting schools, clinics, and remote villages.

These maps confirm a phased rollout strategy opening cheaper tiers only where satellite load permits stable performance. These differences reflect a strategic rollout aimed at balancing demand with available bandwidth.

What this means for you: Cheaper Residential Lite is offered only in regions where Starlink’s network can maintain stable performance.

Competitive Outlook: Can Satellite Challenge Fibre?

Near-Term Outlook (2025–2027)

- Fibre keeps its performance lead.

- Satellite continues to grow as a primary rural solution.

- 5G fixed wireless sits in the middle, with 100–300 Mbps ranges at $50–$60.

Mid-Term Scenarios (2027–2030)

Scenario 1: Satellite Stays Niche (30%)

- Slower V3 rollout.

- Fibre grows rapidly through BEAD initiatives.

- Urban markets remain fibre‑dominant.

Scenario 2: Satellite Becomes Rural Default (60%)

- Successful constellation expansion.

- Significant BEAD funding allocated to satellite deployments.

- Satellite captures 40–50% of rural households.

Scenario 3: Hybrid Household Model (10%)

- Satellite approaches gigabit speeds.

- Fibre pricing adjusts downward.

- Households adopt dual‑connectivity for reliability.

ISP Industry Implications

If Starlink expands the availability of the $40 plan:

- Cable: likely to cut base pricing 15–25% over 3 years.

- Fixed wireless: may lose share in rural markets.

- Fibre: retains urban dominance but may lose BEAD opportunities.

For global markets, satellite may become the preferred option in countries where geography slows fibre deployment examples include as Indonesia, island nations, and mountainous territories.

How to Decide at Your Address

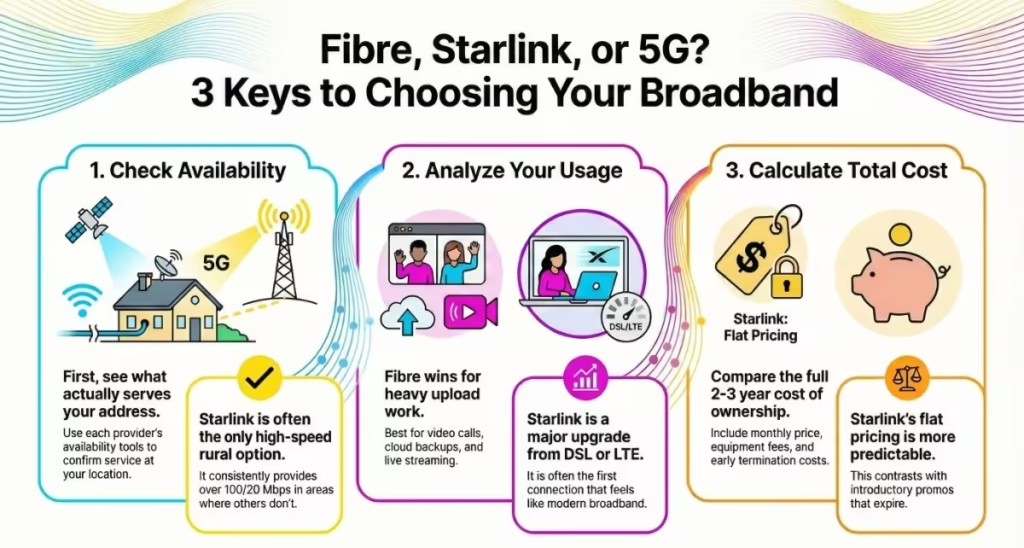

If you’re comparing fibre, Starlink, and 5G fixed wireless at your location, three practical filters usually matter most:

- Availability: First, check which technologies actually serve your address using each provider’s availability tools. In many rural areas, Starlink will be the only option that consistently clears the 100/20 Mbps bar.

- Usage profile: If you rely on upload-heavy work (video, cloud backups, live streaming), symmetrical fibre still wins where it’s available. If you’re moving up from DSL or LTE in a rural area, Starlink’s 100 Mbps tier is often the first connection that truly feels like modern broadband.

- Total cost of ownership: Compare the full 2–3-year cost: monthly price, any equipment or installation fees, and early-termination terms. Entry-level cable promos may look cheaper in year one, but Starlink’s simpler, flat pricing can be more predictable over a multi-year horizon.

Starlink’s $40 plan doesn’t dethrone fibre on performance, but it doesn’t need to. Its purpose is to reshape the economics of broadband where fibre and cable fall short. With strategic pricing, expanding satellite capacity, and wider availability of budget tiers, satellite broadband is no longer a niche fallback. It is now a viable competitor across large rural regions in the U.S., Canada, and parts of Asia.

Fibre remains the best option where available. But the satellite’s upward trajectory, combined with upcoming V3 satellites and shifting federal funding, suggests the competitive gap will narrow over the next five years.

For users outside fibre zones, the $40 plan represents the most accessible form of modern broadband Starlink has ever offered.

$40 for 100 Mbps is a really interesting shift, especially considering how long fibre and cable have held the market – I actually found a helpful overview of internet speeds and options at https://tinyfun.io/game/titans-clicker while researching this. Will be curious to see how Starlink’s performance holds up in real-world testing.