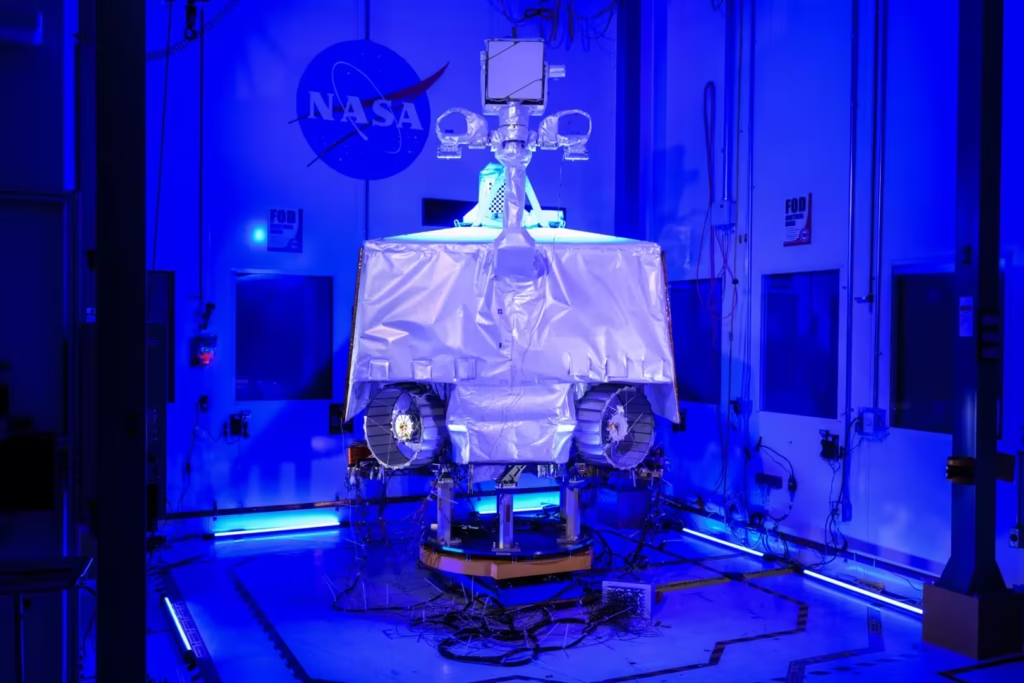

NASA’s Volatiles Investigating Polar Exploration Rover (VIPER) has become a symbol of both the risks and opportunities in modern space exploration. Originally announced in 2019 with an optimistic $250 million budget, VIPER was designed to map water ice at the Moon’s south pole, data vital for the Artemis program and future cislunar infrastructure.

By 2024, lifecycle cost had grown to about $609.6 million, and NASA announced on July 17, 2024, its intent to discontinue VIPER despite the rover being fully assembled. Now, in a sharp reversal, VIPER is set for revival under a CLPS task order with Blue Origin worth up to $190 million, targeting a late-2027 delivery if phased milestones are met.

Accounting for a Cancellation

Cost Timeline

- 2019 (Announcement): $250M estimate, strategically kept low to avoid triggering congressional “major project” oversight.

- 2021 (Formal Baseline): $433.5 million confirmation baseline after Key Decision Point-C, a 73% increase over the initial estimate as the true technical scope became clear.

- 2022 (Delay to 2024): $505.4 million following schedule slips tied to additional testing on Astrobotic’s Griffin lander.

- 2024 (Further Delay): $609.6 million, representing 143.8% growth over the 2019 estimate.

Crossing 30% above baseline triggered NASA’s automatic review process. By July 2024, with the Science Mission Directorate facing a $466M budget cut, leadership determined VIPER’s financial trajectory was unsustainable.

Despite the rover being nearly flight-ready, NASA concluded that continuing the program would jeopardize funding for other priority missions, and canceling appeared to be the only option.

Factors Driving Escalation

- Supply-chain delays after COVID-19 stretched schedules and consumed reserves, as noted by NASA.

- NASA increased insight and oversight on the lander effort, adding about $9.1 million in risk-mitigation scope under CLPS.

- Integration changes on VIPER required modifications to Astrobotic’s Griffin lander, increasing cost and schedule risk.

- Compounding these issues, the Peregrine lander’s propulsion anomaly in early 2024 undermined confidence and pushed Griffin’s schedule further back.

Taken together, these setbacks halted progress and ultimately led to the cancellation, despite $450 million already being sunk into rover development.

The Price of Pausing

Sunk Costs

By July 2024, NASA had spent about $450 million on VIPER, which was fully assembled and undergoing environmental testing, and cancellation was estimated to save only about $84 million in near-term testing and operations. In addition to near-term costs, this raises criticism that it wasted years of development.

Astrobotic’s Contract

- Original task order (2020): $199.5 million.

- Grew with modifications to about $323 million.

- Paid in full despite cancellation, Griffin will still fly to the lunar south pole as a landing demonstration under Task Order 20A.

Opportunity Costs: NASA effectively risked spending ~$773M ($450M rover + $323M lander) for no science return. That amount could have funded:

- Two Discovery-class missions, each typically costing between $450M–$500M, are capable of producing decades of planetary science data.

- Four planetary defense missions, such as NEO Surveyor, provide global risk reduction against asteroid impacts.

- Several smaller lunar technology demonstrations or multiple CLPS deliveries, many of which average under $200M each.

In economic terms, the opportunity cost was stark: nearly a billion dollars in total commitments for zero direct science return.

Beyond the raw figures, the optics of canceling a nearly completed rover created reputational risks, potentially undermining congressional and international confidence in NASA’s ability to manage science priorities. The economic calculus revealed the inefficiency of outright cancellation, especially given VIPER’s near-complete readiness.

CLPS CS-7 Economics: Blue Origin’s $190M Contract

Contract Structure

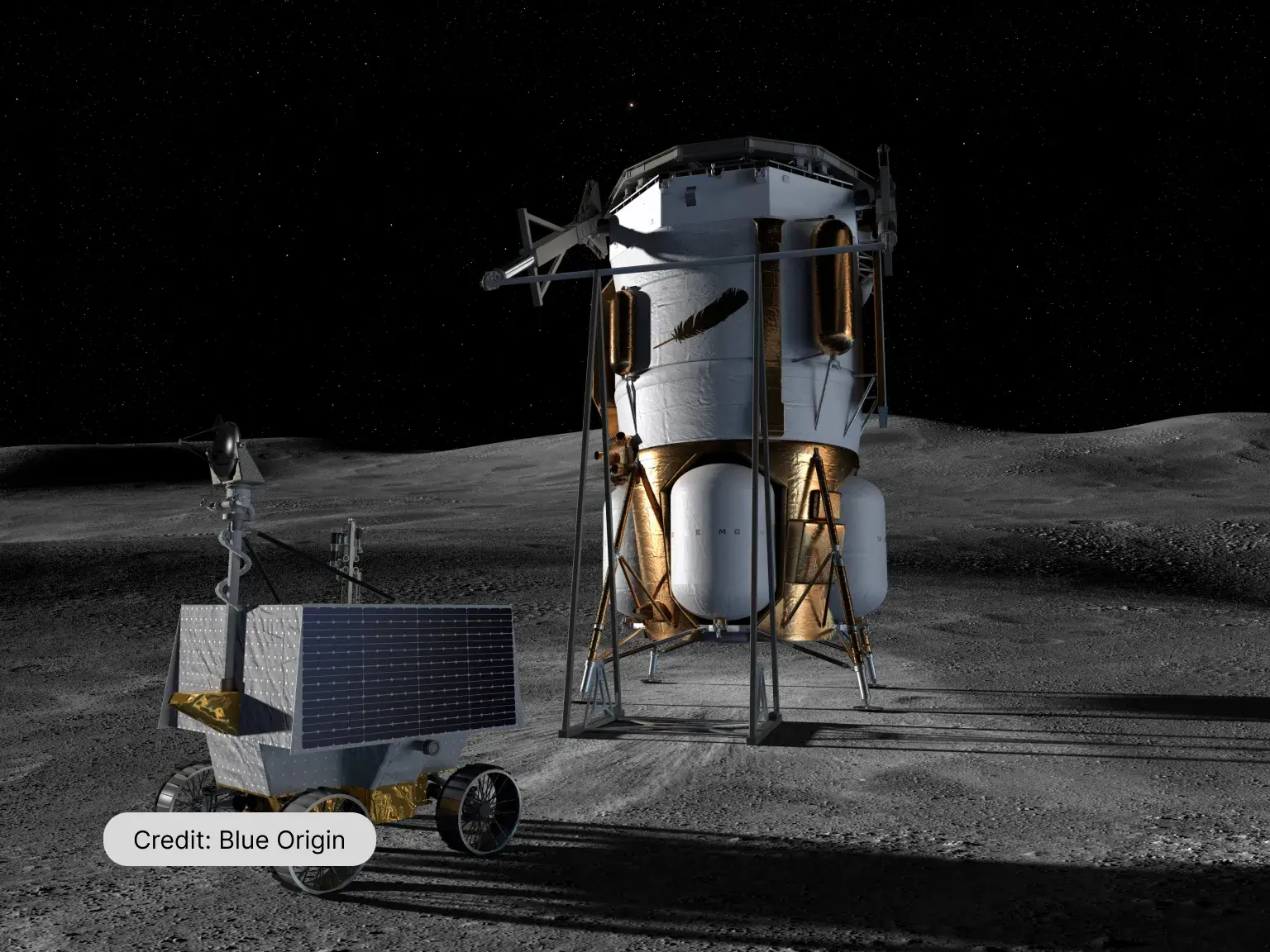

In September 2025, NASA awarded Blue Origin a CLPS task order (CS-7) with a total potential value of $190 million, structured with a phased base and an option for delivery after a Blue Moon Mk1 demonstration, targeting late-2027.

Unlike Astrobotic’s more traditional end-to-end delivery approach, CS-7 is structured in phases, providing NASA with decision gates along the way:

- Phase 1: Blue Origin must design the specific payload accommodations for VIPER, demonstrate how the rover can be securely mounted on the Blue Moon Mk1 lander, and validate the mechanisms for offloading to the lunar surface.

- Phase 2 (Option): Only if Phase 1 succeeds, and after Blue Moon Mk1 completes its first demonstration landing, will NASA authorize the actual delivery of VIPER to the Moon.

This milestone-based structure not only transfers technical and schedule risk to Blue Origin but also gives NASA an off-ramp if integration or testing falls short. By tying payments to performance, the agency avoids repeating the experience of paying for a lander service without receiving the intended science return.

Competitive Advantage

- Blue Origin’s Mk1 lander is already in production for a 2025 mission.

- Honeybee Robotics (a Blue Origin subsidiary) built VIPER’s TRIDENT drill, aligning incentives for mission success.

- At ~$442K per kg delivered, the Blue Origin contract is far more cost-efficient than the ~$2.17M/kg of the canceled plan.

The revival reduces VIPER’s total cost to ~$640M ($450M sunk + $190M new contract), compared to ~$933M if continued with Astrobotic.

Comparative Cost Scenarios

| Scenario | Rover Cost | Lander Cost | Total | Outcome |

|---|---|---|---|---|

| Cancellation (2024) | $450M sunk | $323M | ~$773M | No science return |

| Continuation w/ Astrobotic | $609.6M | $323M | ~$933M | Delivery by 2025–26 (uncertain) |

| Blue Origin Revival | $450M sunk | $190M | ~$640M | Delivery by 2027 (risk-mitigated) |

The Blue Origin path minimizes losses while keeping VIPER’s science goals alive.

Long-Term Returns on Investment

Scientific Payoff

VIPER will spend approximately 100 days at the lunar south pole, drilling up to one meter deep to directly characterize water ice deposits in permanently shadowed craters. The rover’s four instruments, including the TRIDENT drill, will allow NASA to sample regolith at different depths and measure both concentration and accessibility of volatiles. This provides:

- Reliable “ground truth” data for In-Situ Resource Utilization (ISRU) models that currently rely on orbital measurements.

- A scientific basis to prioritize Artemis landing zones, power system designs, and life-support infrastructure.

- Insights into the thermal and mechanical properties of icy regolith, which influence mining and processing approaches.

Economic Impact Scenario / Assumptions (Model-based; not forecasts)

- Recent datasets on cost to low Earth orbit show a wide range, from low single-thousands to well over $10,000 per kilogram, depending on vehicle and procurement; use a range rather than a single average.

- Delivered price for lunar-derived propellant may fall into the low-$k/kg range in some modeled architectures, but any $/kg value should be treated as an assumption tied to power, mining, and transport choices.

- In modeled scenarios, lunar propellant demand could reach ~450 metric tons per year, implying order-of-magnitude revenues around $2–3B per year under these assumptions.

- Secondary markets could emerge around oxygen for life support and hydrogen for industrial processes if ISRU proves technically and economically viable.

Strategic Value

By reducing uncertainty around lunar resources, VIPER enables private firms to make investment decisions with greater confidence. The mission acts as a catalyst for a projected multi-trillion-dollar cislunar economy by 2050.

Its outcomes extend beyond Artemis: the data can underpin commercial ventures such as mining operations, orbital propellant depots, and eventually manufacturing hubs near the Moon. In this way, VIPER’s scientific return translates directly into long-term economic and strategic advantage for the United States and its partners.

Conclusion

The VIPER mission illustrates the fragile economics of lunar exploration. Its near-cancellation showed how short-term budgetary pressures can undermine strategic goals, while its revival highlights the role of creative contracting and commercial partnerships in salvaging value.

Blue Origin is now tasked to deliver VIPER by 2027. NASA has found a middle ground between fiscal discipline and scientific ambition. If successful, VIPER’s data could reshape the economics of space, turning sunk costs into the foundation of a future cislunar economy.

Key Takeaway: VIPER’s revival is not just about sending a rover to the Moon, it’s a financial case study in how institutions manage sunk costs, restructure partnerships, and invest in long-term strategic returns.